Français

Français

Deutsch

Deutsch  Englisch

Englisch

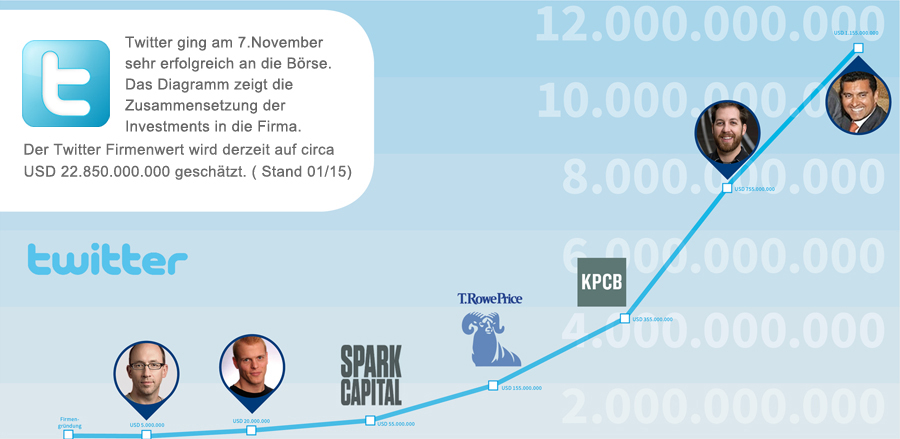

We reveal ourselves to the world in 140 characters. Twitter is an internet phenomenon. The company has only been in the red for years, growth is weakening, but the IPO was still extremely successful.

In 2006, Jack Dorsey developed the software "Twttr" together with Biz Stone, Evan Williams and Noah Glas. The idea: to publish status messages with a maximum of 140 characters via SMS or on the internet and thus share one's thoughts with friends, colleagues or acquaintances. This is how Twitter came into being. Today, Twitter is a text messaging service with around 230 million active users per month worldwide.

The platform is particularly popular with well-known personalities from the fields of film, television, sport, politics or science, who keep their Twitter followers up to date with regular entries.

On 21 March 2006, Jack Dorsey tweeted his first tweet: "I'm just setting up my twttr", and so began the success story of the short message service. Today, around 500 million tweets are sent every day.

This entry, like all other tweets that were not manually deleted, can still be found today.

The CEO and co-founder of the company, Suhail Rizvi, is very media-shy. He has very good relations with the royal family of Saudi Arabia. Rumour has it that Prince Alwaleed has invested heavily in the internet company through Rizvi. Suhail Rizvi can sell his shares today for about 3,820,000,000 USD, but he has to hold them for at least 1/2 year.

Together with Biz Stone and Jack Dorsey, he developed the Twitter software and founded the company of the same name in April 2007. In October 2010, he announced that former COO Dick Costolo would succeed him as CEO. He owns about 59 million shares. But he has to keep them for six months. Theoretically, the company would have made a profit of around USD 2,560,000,000,000 from the IPO.

Demand was 30 times greater than the number of shares available. The chances of an allotment at the issue price were slim, especially for private investors, since only around eight million

eleven percent shares were allotted. Supply and demand set the price. This explains the high share value at the time of the IPO.

Many analysts believe that the company is riskily overvalued. The share's success can only be sustained if the company gets out of the red. For this to happen, Twitter needs to earn money. Like Facebook, Twitter generates its revenue from paid advertising.

| 2006 | 2007 | 2008 | 1HBJ./2009 | 2HBJ./2009 | 2010 | 1HBJ./2011 | 2HBJ./2011 |

|---|---|---|---|---|---|---|---|

| Company formation Twitter Inc. |

Investition A $ 5.000.000

|

Investition B $ 15.000.000

|

Investition C $ 35.000.000

|

Investition D $ 100.000.000

|

Investition E $ 200.000.000

|

Investition F $ 400.000.000

|

Investition G $ 400.000.000

|